Tesla Fills Elon Musk’s Chairman Role With Board Member Robyn Denholm

Tesla Inc. appointed a director who’s been on its board for years to replace Elon Musk as chairman, stirring suspicion as to whether the mercurial CEO will be restrained after costly run-ins with securities regulators.

Robyn Denholm, 55, will assume the chairman’s role immediately. A director since 2014, she’ll leave her position as chief financial officer and head of strategy at Australian telecommunications company Telstra Corp. after a six-month notice period.

Analysts fear Denholm is too allied with the now former chairman, Elon Musk. (Ron Sachs/Bloomberg News)

The appointment marks the end of an era for Musk, 47, who became chairman when he led a $7.5 million initial investment in Tesla in April 2004. His problematic August tweets about trying to take the company private caused months of chaos and culminated in a settlement with the U.S. Securities and Exchange Commission. The agency sought to improve the governance of a board long criticized for being too closely aligned with its billionaire leader.

“While Denholm is technically an independent member of the board, she has been part of the Musk team for some time now and that suggests she will not be up to the task of checking Musk’s worst instincts,” said Stephen Diamond, a professor of law at Santa Clara University who specializes in corporate governance. “And, of course, that was the whole point of the SEC settlement.”

Ceding the role of chairman was a condition of the accord Musk reached with the SEC in September to settle fraud charges related to his tweets on taking the company private.

In addition to a three-year ban from serving in the job, Musk and Tesla agreed that the company would add two new independent directors to the board by late December. Tesla is searching to fill those posts.

In our debut episode of RoadSigns, we ask: What does the move toward autonomy mean for the truck driver? Hear a snippet from Alex Rodrigues, CEO of Embark, above, and get the full program by going to RoadSigns.TTNews.com.

“This is a good first step,” Dieter Waizenegger, executive director of CtWInvestment Group, said of Denholm’s appointment. CtW, a union-affiliated activist group, had been critical of Tesla’s corporate governance.

“The ball is now in her court,” Waizenegger said via e-mail. “Can she overhaul the board and revamp the relationship with the CEO to guide the company toward sustainable success?”

Denholm, who has only been in the Telstra CFO job for a little more than a month, said she plans to devote herself full-time to Tesla when her obligations to the Melbourne-based company are complete. She won’t take on another job.

“I believe in this company, I believe in its mission and I look forward to helping Elon and the Tesla team achieve sustainable profitability and drive long-term shareholder value,” Denholm said in the statement.

Denholm’s appointment comes as a bit of a surprise, as she ruled herself out as a candidate to Australian media a month ago. It’s not clear what convinced her to give up the CFO job at one of the country’s most prominent companies for the high-profile task of chairing Tesla.

Denholm worked previously at Toyota Motor Corp., Sun Microsystems Inc. and Juniper Networks Inc., where she was chief financial and operations officer. She serves on Tesla’s audit and compensation committees and is one of two directors who the company considers to be a financial expert. She’ll temporarily step down as chair of the audit committee until she leaves Telstra.

“Robyn has extensive experience in both the tech and auto industries, and she has made significant contributions as a Tesla board member over the past four years in helping us become a profitable company,” Musk said in the statement. “I look forward to working even more closely with Robyn as we continue accelerating the advent of sustainable energy.”

Once Denholm leaves Telstra, she’ll be paid an annual cash retainer of $300,000 along with stock options, according to Tesla. Last year, she was the highest-compensated director on the board, making $4.9 million, with 99% of that coming in the form of option awards.

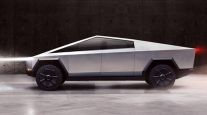

Musk revealed the Tesla Semi last November. (Alexis Georgeso/Tesla Inc.)

Tesla’s board, which includes Musk’s brother, Kimbal, has long come under fire from corporate governance experts for lacking independence and being made up of Musk loyalists.

Several are investors in or directors at SpaceX, the closely held rocket company that Musk also runs. That includes Steve Jurvetson, who’s been on a leave of absence for about a year, since accusations of misconduct spurred his resignation from the venture capital firm he co-founded.

Directors will create a permanent committee to ensure implementation of the terms of the SEC settlement, which include setting up procedures and controls to oversee Musk’s communications — including his tweets. Tesla has to employ or designate a securities lawyer to review messages that senior officers send through Twitter and other social media.

CtW and officials representing major pension funds in four states have called on Tesla to go beyond the terms of the SEC settlement to fix its corporate governance issues. In a letter last week, the group called for the creation and release of a plan to refresh the board and for timelines to be set for some members to leave.