Shipping Shows Signs of Panic as Houthis Menace Trade Lane

[Stay on top of transportation news: Get TTNews in your inbox.]

Container shipping is set to face a crunch ahead of the Lunar New Year holiday as Houthi attacks in the Red Sea restrict capacity, a major industry consultant said. Meanwhile, shares in some of the world’s top shipping companies tumbled — then pared their declines — after a report that some firms had done a deal with Yemen’s Houthi militants to get their vessels safely through the Red Sea.

Such a pact — immediately denied by two of the world’s largest lines — would mean faster sailing distances between Asia and Europe, causing the supply of vessels to jump. The accord was reported by Danish publication ShippingWatch.

A.P. Moller-Maersk A/S tumbled as much as 8.4%, the most in two months, while Hapag-Lloyd AG slid as much as 11%. Both confirmed they were still staying away. Freight forwarding giant Kuehne + Nagel said its latest information was that all the top lines were still avoiding the area — something the ShippingWatch report did acknowledge.

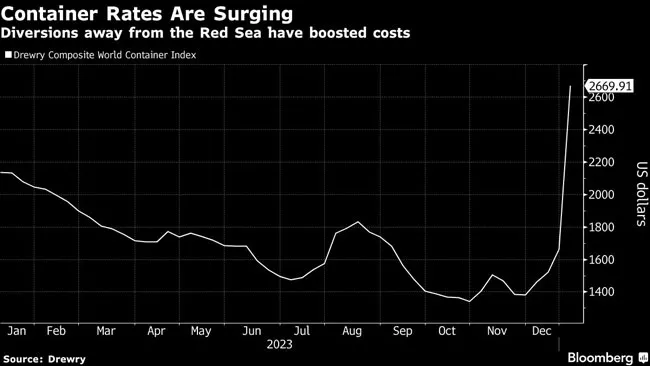

Shipping stocks have been boosted in recent weeks by predictions that the attacks by rebels would send shipping rates higher as firms avoid the Red Sea and crucial Suez Canal.

The coming weeks are likely to be very difficult as trade volumes ramp up before Lunar New Year, which begins Feb. 10, according to Philip Damas, managing director and head of supply chain advisers at Drewry Shipping. Diversions as a result of the attacks are forcing ships to sail thousands of miles farther than normal and are therefore restricting the number of vessels able to carry goods.

Over the weekend, the number of transits through the Suez Canal fell to the lowest since the waterway was blocked by the Ever Given containership in 2021, according to Inchcape Shipping Services. It offers another sign of the wider impact of the disruption on world trade, one that’s set to persist in the run-up to Lunar New Year.

“There is something of a panic in China now about the availability of capacity,” Damas said. “The next five weeks leading to Chinese New Year on Feb. 10 are going to be very difficult for shippers and for shipping,” though costs could ease after that, he added.

Iran-backed Houthi militants in Yemen have been firing drones and missiles at ships passing by the country’s waters, roiling global trade. They say they are targeting vessels with links to Israel to protest against its military campaign in the Gaza Strip, though there have been frequent attacks on vessels with little or no link to Israel. The Houthis have attacked at least 24 merchant ships over the past several weeks; as a result, swaths of global sea traffic are choosing to avoid the waterway and sail around Africa.

For containerships, that’s particularly key ahead of Lunar New Year, when there is increased shipping demand before the holiday season. Much of China shuts down during the break, leading to higher levels of congestion at ports too.

Drewry, which offers advisory services to global shippers, estimates that as many as 822 ships, or the capacity of about 10 million containers, have been impacted by the attacks and resulting diversions.

Want more news? Listen to today's daily briefing above or go here for more info

The impact of the attacks is wending its way to other sectors too. Earnings for ships hauling fuel from the Mediterranean to Asia have more than tripled since the start of December to the highest level in almost a year. Shipbroker Braemar last week said that the costs for vessels on any tanker route involving the Red Sea are “red hot.”

Maersk ranks No. 5 on the Transport Topics Top 50 list of the largest global freight companies. Kuehne + Nagel ranks No. 9 and Hapag-Lloyd ranks No. 13.