Staff Reporter

N.J. Diesel, Gas Taxes Go Up by Nearly 1¢ Oct. 1

[Stay on top of transportation news: Get TTNews in your inbox.]

New Jersey’s diesel and gas prices will rise nearly a cent starting Oct. 1 due to the first uptick in state fuel taxes since 2020, according to the state treasury department.

“Because actual consumption in fiscal year 2023 was slightly below our projections made last August, primarily due to lower diesel use, and because consumption in the current fiscal year is projected to be just above last fiscal year’s levels, our analysis of the formula dictates a 0.9-cent increase this coming October,” Elizabeth Maher Muoio, state treasurer, said recently.

As per a formula in a 2016 state law, New Jersey’s petroleum products gross receipts (PPGR) tax rate will increase Oct. 1 on diesel to 35.8 cents per gallon (from the current 34.9 cents) and for gasoline to 31.8 cents (compared with 30.9 cents) a gallon.

When combined with the per-gallon motor fuels tax fixed at 13.5 cents for diesel fuel and 10.5 cents for gasoline, drivers will be paying per gallon 49.3 cents for diesel and 42.3 cents for gas.

The state Highway Fuels Revenue Target must be reviewed annually each August by the New Jersey treasurer in consultation with the state legislative budget and finance officer regarding fuel consumption data and revenue collections. Fuel taxes can be raised or lowered depending on various factors.

Muoio

Based upon that August assessment, officials forecast for FY2024 that the highway fuels revenue target is $1.96 billion.

“As mandated by the 2016 law, this dedicated [formula] funding stream continues to provide billions of dollars across the state to support crucial transportation infrastructure needs,” Muoio said.

Highway fuels revenue collections in FY2023 are projected to drop below the $8.2 million revenue target. Another determining factor in the financial calculation was having $5.3 million less in the FY2023 $43.1 million surplus than was forecast in August 2022. (Highway fuels consumption numbers must be estimated every June because actual data is unavailable in time for the annual rate review.)

Lower-than-expected consumption of gasoline and diesel fuel in FY2023 that “trailed by 7.6% from pre-pandemic levels in FY2019 and 12.6% from the FY2016 baseline consumption level” have triggered the new PPGR tax hike “to make up for the shortfall in highway fuel revenue collections from the prior fiscal year,” the treasury stated.

Want more news? Listen to today's daily briefing above or go here for more info

This lower fuel consumption trend is predicted to continue as motor fuel consumption is lagging below base year FY2016 levels.

“While consumption of gasoline and diesel fuel in FY2024 is projected to be 11.3% lower than FY2016 levels due to remote work and increasing fuel efficiency, it is expected to be 1.4% above FY2023 levels,” the treasury predicted.

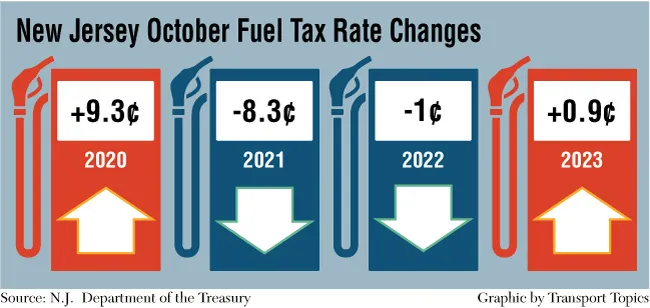

This PPGR tax hike is the first in recent years. The PPGR rate actually dropped in FY2022 (by 1 cent) and in FY2021 (by 8.3 cents) on both diesel and gasoline per gallon.