Bloomberg News

Shipping Giant CMA CGM Posts Loss as Red Sea Conflict Rages

[Stay on top of transportation news: Get TTNews in your inbox.]

CMA CGM SA, the world’s third-largest container line, posted its first quarterly loss in four years as the shipping industry struggles with the conflict in the Red Sea and the specter of overcapacity.

The French company, controlled by billionaire Rodolphe Saade and his family, reported a loss of $93 million in the final three months of 2023 compared with profit of $3.04 billion a year earlier. A statement released Feb. 23 painted a subdued outlook “shaped by sluggish global economic growth.”

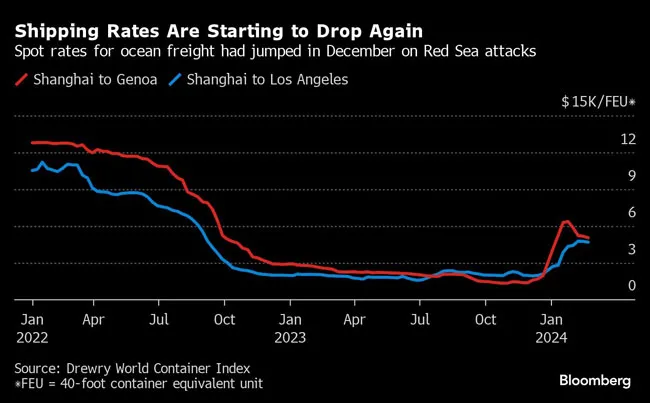

Much of the global merchant fleet has avoided the Red Sea and Suez Canal since mid-December after a series of attacks on vessels by Yemen-based Houthis. The area has grown even more volatile after the U.S. and U.K. responded with airstrikes on the militants’ positions on land.

CMA CGM was one of the last major carriers to suspend passage in the conflict zone, where a cargo ship caught fire this week after a missile attack.

“When it becomes possible — when security conditions allow it, and notably with an escort from the French navy, we’ll determine on a case-by-case basis whether it’s possible to navigate a vessel” through the zone, Chief Financial Officer Ramon Fernandez said on a call, without indicating when that might be.

Detours around southern Africa have raised fuel and other costs substantially for shipping companies, which in turn pass those expenses to their customers in the form of surcharges. Although spot freight rates surged in response to the threats, they have since tapered off, Fernandez said.

CMA CGM, which ranks No. 7 on the Transport Topics Top 50 Global Freight Companies list, follows rivals A.P. Moller-Maersk A/S and Hapag-Lloyd AG in outlining difficult prospects in the near term for the notoriously cyclical industry, partly based on sluggish economic growth.

“Volume growth should remain strong in the first half, buoyed by prior-year comparatives, but the second half looks more uncertain,” CMA CGM said in the statement. “New container shipping capacity is expected to come into service, pushing global supply in excess of forecast demand, with an adverse impact on freight rates.”

The closely held company based in Marseille is reducing costs, although Fernandez said a specific jobs reduction plan isn’t underway.

The industry’s reversal of fortunes began in the second half of 2022, after an unprecedented boom in demand during the pandemic sent cargo rates soaring and profits to record highs.

The windfall led CMA CGM and others to order vessels that are now entering service. Global capacity is expected to rise by a similar level this year to the 8% in 2023, according to Fernandez.

New Ships Arriving

CMA CGM has about 100 new vessels on order, he said, and these will be added to a fleet that now stands at about 620.

Want more news? Listen to today's daily briefing above or go here for more info

Surging profits over the previous two years filled the coffers of the Saade family and rival European shipping tycoons like Gianluigi Aponte, founder of Mediterranean Shipping Co., and Klaus-Michael Kuehne, who has stakes in logistics and shipping companies.

CMA CGM went on a buying spree to diversify into logistics, air cargo and media. Last month, it scrapped an alliance with Air France-KLM that would have boosted its capacity in the sector.

On Feb. 23, Fernandez said “it’s not impossible” that the shipping company could order additional A350 freighters from Airbus SE to add to the four already in the pipeline for delivery at the start of 2026.

CMA CGM is still working to close its biggest purchase to date: Bollore SE’s logistics arm for an enterprise value of 5 billion euros ($5.4 billion).

“Never say never,” Fernandez said when asked about plans for more acquisitions, adding that the company is keeping an eye out for further opportunities.

The Saade family is worth $23 billion, according to the Bloomberg Billionaires Index.