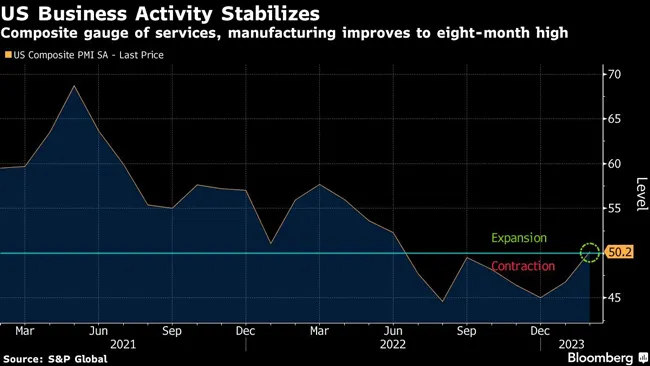

Business Activity Steadies in February, Boosted by Services Increase

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. business activity steadied in February as the service sector regained its footing, suggesting a resilient economy that is keeping some pricing power intact.

The S&P Global flash February composite purchasing managers index climbed 3.4 points to 50.2, the group reported Feb. 21. While the gauge is the highest in eight months, it’s barely above the 50 level that separates growing and shrinking activity.

The figures follow similar gauges of output in the U.K., Germany and France — which all returned to growth in February — suggesting the global economy is withstanding elevated inflation, higher interest rates and the war in Ukraine.

The group’s U.S. composite measure of employment at manufacturers and service providers rose to a five-month high, indicating still-solid demand for labor. While growth in input costs eased, the index of prices received climbed to a four-month high.

The report also showed a measure of future output rose to the highest level since May, indicating greater optimism about demand.

“Despite headwinds from higher interest rates and the cost-of-living squeeze, the business mood has brightened amid signs that inflation has peaked and recession risks have faded,” Chris Williamson, chief business economist at S&P Global Market Intelligence, said in a statement.

At the same time, “the survey data underscore how the upward driving force on inflation has now shifted to wages amid the tight labor market,” Williamson said.

Such sustained wage pressures may encourage Federal Reserve officials to consider additional interest-rate increases and keep higher borrowing costs in place for longer.

The group’s measure of services showed expansion for the first time since June, likely due in part to unseasonably warm weather in the month. Meantime, the manufacturing index showed a slower pace of contraction.

— With assistance from Chris Middleton.

Want more news? Listen to today's daily briefing below or go here for more info: