Document Automation Puts Trucking Back Office in Fast Lane

[Stay on top of transportation news: Get TTNews in your inbox.]

The deluge of documents that trucking generates is increasingly managed and processed via automation. Providers of document-management systems, and the trucking executives who use them, said these systems yield labor savings and efficiencies.

Automating the processing of documents also benefits shippers, carriers, freight brokers and logistics providers by accelerating the completion of transactions — helping all parties pay and get paid more quickly, vendors and trucking executives said.

Solar Transport, which transports petroleum products, uses services from EBE Technologies, including a mobile app that enables document capture for billing and settlements.

Solar Transport is developing electronic delivery tickets with EBE Technologies. (Solar Transport)

The West Des Moines, Iowa-based fleet is developing electronic delivery tickets with EBE, said Jason Jones, Solar Transport’s IT manager.

Other document-management changes are afoot at the carrier.

Drivers have been using their personal devices to access the EBE mobile scan app.

“We are currently implementing iPads into our fleet, and drivers will use the iPad to scan their images now,” Jones said, noting the main reasons for the switch are lower cost and more flexibility and mobility. “We want more flexibility for our drivers to be able to see and do their job remotely.”

This is not only for their day-to-day operational job, but for training at home using EBE software, Jones said.

“That has allowed driver training to take place on a monthly basis,” Jones said. “[The] safety department has been able to stay atop of the training with notifications and a workflow to monitor the training.”

Meanwhile, the technology for automatically digitizing and processing documents has advanced because of improvements in artificial intelligence, especially optical character recognition and machine learning, vendors said.

EBE Technologies mobile app by EBE Technologies.

“What used to happen in the back office when the paperwork arrived is now happening at the point of service with the driver,” said Larry Kerr, president of EBE Technologies. The delays associated with waiting until drivers reach a truck stop or a terminal to scan documents can be dramatically reduced or even eliminated through automated document management, he said.

Some users are able to issue invoices within 10 minutes after delivery, Kerr said. “But more importantly, the [work in the] back office, where you had to start indexing and billing, is reduced down to [managing] exceptions.”

Automated indexing — such as ascribing an order number and driver code to facilitate document processing — saves carriers hours of labor that were once devoted to billing, vendors said.

“Usually, the higher the transaction volume, the greater the payback,” Kerr said.

Brent Bois, owner of Calhoun Truck Lines, said trucking companies must manage “a lot of information — information in different parts of the document and different information from different customers, creating a challenging process for order-entry personnel.”

His company, an intermodal carrier based in Eden Prairie, Minn., is working with KoiReader to automate its order-entry process.

“We get a certain percentage of our orders coming over from our customers via [electronic data interchange], but we still have a lot of orders coming via e-mail,” Bois said.

The e-mailed orders are manually entered into the carrier’s transportation management system. Automating the handling of e-mailed orders is expected to free operations staff for other tasks, Bois said, adding it also reduces “some of the human error that causes additional challenges downstream within our operations.”

He said he expects the automated order-entry process to be operational, and a return on investment achieved, by year’s end.

Calhoun’s transportation management system is provided by Compcare Services, a software firm that specializes in intermodal operations. Calhoun Truck Lines, which operates 160 trucks, has used the management system for about 15 years, Bois said.

KoiReader and Compcare had to collaborate in advance for the automation project now underway, Bois said. The basic challenge is the moving of information across an open application programming interface. The interface is software that enables different applications to “talk,” or work together.

A Calhoun Truck Lines employee works on document processing. Calhoun Truck Lines is working with KoiReader to enhance its document management processes. (Calhoun Truck Lines)

“I needed to have Compcare on board to make sure they were open to working with KoiReader,” Bois said.

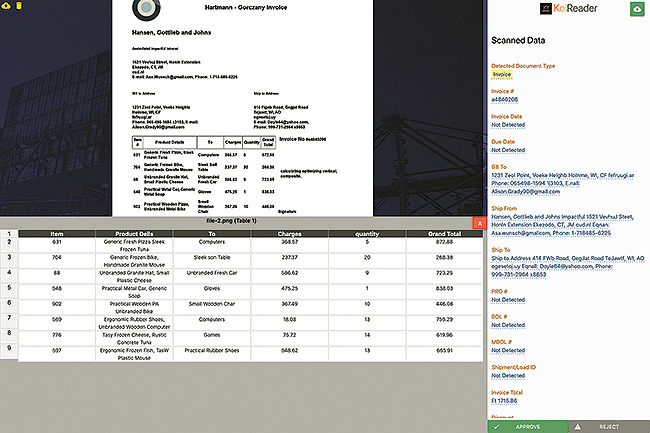

KoiReader, based in Dallas, launched its automation products in May. The products comprise a suite of application programming interfaces, or APIs, designed to digitize “unstructured” freight documents such as scans and JPEGs into structured data formats for integration into carriers’ back-office systems.

The system automates document classification, invoicing and bills of lading by integrating with transportation management systems, said CEO Ashutosh Prasad.

Bois said his company’s use of automated document management includes driver files related to safety and hiring. The carrier manages those records with software provided by DriverReach.

“We can see that a driver has submitted the correct information that we need in order to bring him or her aboard without seeing the information on that document,” Bois said. “Only HR can see the information on the form.”

In May, another new partnership was announced — one between HubTran and McLeod Software, a supplier of transportation management and trucking software. HubTran markets software that uses artificial intelligence to read, audit and organize documents, and to automate invoicing and the issuing of payments to carriers.

HubTran’s use of AI includes machine learning to assess documents and pull needed data from them. Also, its method employs optical character recognition, which other systems use too. But OCR only does a small part of the job, CEO Matt Bernstein said.

“That only gets you 5% of the way, because all OCR is doing is lifting the text off of a page,” he said.

That leaves questions, Bernstein said. These questions include, what does that text mean? How does it relate to what needs to be accomplished? For example, the system might need to identify the company that sent a document.

“That’s where we’re using ML — machine learning,” Bernstein said.

The idea behind machine learning is that systems can “learn” from data by identifying patterns and make decisions without input from people.

Managing documents is developing to the point that it isn’t exclusively about documents.

This year, Trimble Transportation introduced video imaging capture — software that works in tandem with an in-cab camera — and is working on linking it to its document management module, said Jay Delaney, senior director of product management.

The company is looking to integrate that into its document-management solution so that if there’s a claim, an accident or citation, the video can be included in the associated “document trail,” Delaney said.

Trimble also will be releasing a risk management module that will tie into the document management software so that users will be able to track events, citations and claims.

Ultimately, improving document management can play a large role in streamlining business operations.

“Documents are still really the financial trigger” for the industry, without which nothing happens, said Don Burke, chief operating officer at Transflo.

KoiReader's system automates document classification, invoicing and bills of lading, the company says. (KoiReader)

The technology firm helped trucking companies manage 600 million documents in 2018, and expects to manage close to 1 billion documents for its customers this year, Burke said.

He attributed the expected increase to freight brokers around the country using more small carriers: “The four-truck guys, the 12-truck guys, the 20-truck guys.”

Transflo, a business unit of Pegasus TransTech, offers a range of software and services for the trucking industry, including Transflo DocuType, an automated document classification and indexing system.

In the less-than-truckload sector, document management has some differences and some parallels. A difference is that bills of lading and proofs of delivery are always separate documents, said Ben Wiesen, president of Carrier Logistics, a management software provider for LTL companies.

“One thing LTL is trying to do is get away from those documents,” Wiesen said. “It’s unwieldy to manage all those pieces of paper.”

That’s why LTL companies have deployed electronic signature capture, Wiesen noted.

As in the truckload industry, “In order to complete these tech solutions, we have to integrate disparate systems in a way that the end-user experience is seamless,” Wiesen said. Carrier Logistics partners with DDC FPO, a provider of business-process outsourcing for the transportation industry.

“Over the last seven years or so, DDC and CLI have had an informal partnership, in which DDC fulfills data entry and processing needs for CLI’s carrier clients,” said Chad Crotty, vice president of sales for DDC in North America. The company’s AI service, DDC Intelligence, was launched in 2014 and has received several updates since.