ATA Tonnage Index Jumps 8.2% in August

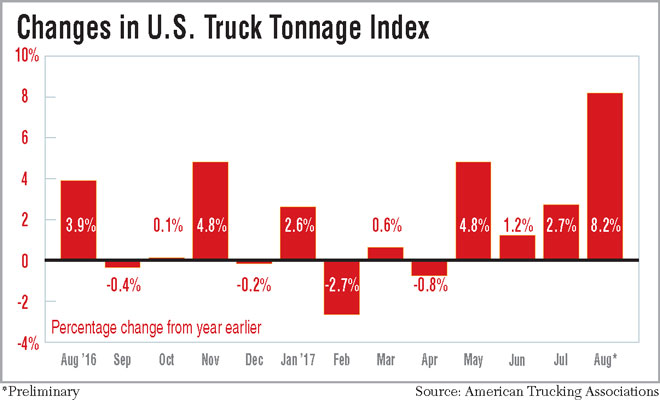

Truck tonnage in August took a healthy 8.2% step up, perhaps driven by hurricane preparation work and port shipping, American Trucking Associations said Sept. 19.

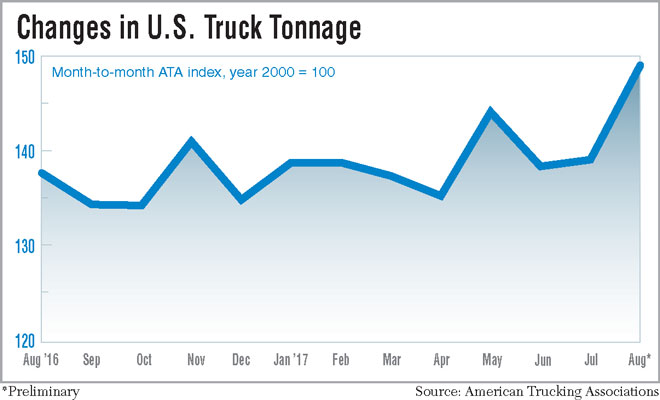

ATA said its seasonally adjusted index hit 149, up from 137.7 in August 2016. The latest reading for the index (which uses business activity from the year 2000 as a base level of 100) set a record with an incremental increase over the May reading of 144.1, the previous record. Prior to May’s performance, the record was set in February of this year.

Month-to-month changes revealed August rose 7.1% over the July figure of 139.1, which was revised up from a preliminary reading of 138.5.

Costello

Through Aug. 31, the tonnage index has increased by 2.1% over the same span in 2016, the ATA report said.

“Tonnage was stronger than most other economic indicators in August and more than I would have expected,” said ATA Chief Economist Bob Costello, the author of the study.

“However, prep work for the hurricanes and better port volumes likely gave tonnage an added boost during the month,” he said. “I suspect that short-term service disruptions from when the storms made landfall, as well as the normal ebb and flow of freight, could make September weaker, and tonnage will smooth out to more moderate gains, on average,” Costello added.

The raw, unadjusted index was 156.4 in August, an increase of 10.5% over the July reading of 141.6, although July is usually a weak month for shipping.

Eagle Systems, an intermodal carrier based in Wenatchee, Wash., has been doing well, CEO Jeff Lang said.

“We move a lot of consumer goods, especially inbound containers transloaded into 53-foot boxes. There’s been a slight uptick,” Lang said.

This year has been noticeably busier than 2016, Lang said, and would be busier still if he could find more drivers to move loads.

“We’ve been constrained by our capacity to haul and we’re trying to ramp that up,” he said.

While January and February were decent months, Lang said March was a turning point.

“That’s the month where things started to tick up for us,” he said. “It’s been a good year.”

Texas is part of Eagle’s operating territory, Lang said, and while the state ravaged by Harvey needs a lot of freight going in, it has also resumed producing outbound loads. Eagle is once again hauling plastic resins out of the Lone Star state.

TONNAGE jumps in August. Read more: https://t.co/BrL7krIjEv pic.twitter.com/SgK4bYFjMH — American Trucking (@TRUCKINGdotORG) September 19, 2017

Both consumer and industrial spending are improving, according to Cass Information Systems.

“Data is suggesting that the consumer is finally starting to spend a little, albeit not with brick and mortar retailers,” meaning that e-commerce is providing the incremental growth, said Donald Broughton, author of the report for Cass.

On the industrial side, Broughton said, “The overall freight recession, which began in March 2015, appears to be over and, more importantly, freight seems to be gaining momentum in most segments.”

On Sept. 19, Cass published its monthly look at shipments and spending and both increased in August.

The shipments index rose by 3.9%, year-over-year, to 1.158, while the firm’s expenditures index leaped 9.7% to 2.499. Both indexes use January 1990 as a base period of 1.0.

The shipments index has been increasing for nine straight months and expenditures for eight.

“Throughout the U.S. economy, we are continuing to see a growing number of data points suggesting that the economy continues to get incrementally better. Some data points are simply less bad and a few of them are much better,” Broughton said.

Load board operator Truckstop.com said the week ended Sept. 16 was the busiest time the company has seen either this year or in 2016.

“The spot market has heated up considerably — we’ve been kidding that it’s like 2014 on steroids,” said Trent Broberg, general manager of marketplace solutions for the firm.

Truckstop.com calculates a weekly Market Demand Index, or MDI, which was 38.8 for the period ended Sept. 16. The average per-mile rate has also been inching up to $2.31 from $2.19 the week ended Aug. 26.

While shipping related to hurricanes Harvey and Irma has been a shock to the national freight market, the Truckstop.com index shows consistent spot-market activity since late February.

Broberg said it’s not an unbridled freight boom, but tight availability — probably from fears related to the electronic logging device rule — coupled with a supply of loads to be moved that has “increased a little bit.”

Hurricane Harvey came ashore in Houston late last month and flooded the area after a record 52 inches of rainfall. Hurricane Irma this month flooded much of Florida.

In looking at types of equipment, Broberg said his MDI numbers show the greatest demand is for flatbed and refrigerated rigs. Flatbeds are needed to haul rebuilding supplies into Florida and Texas — and generally supply the nation’s construction industry,” he said.

As for reefer equipment, Broberg said the federal Food Safety Modernization Act has placed high-quality equipment at a premium.